SELL PROPERTY | BUY | FINANCE | NEWS

News Update

Research Brief

November 9, 2021

Employment

- Employment Market Firms Amid Wane in Infections; Winter Headwinds Present

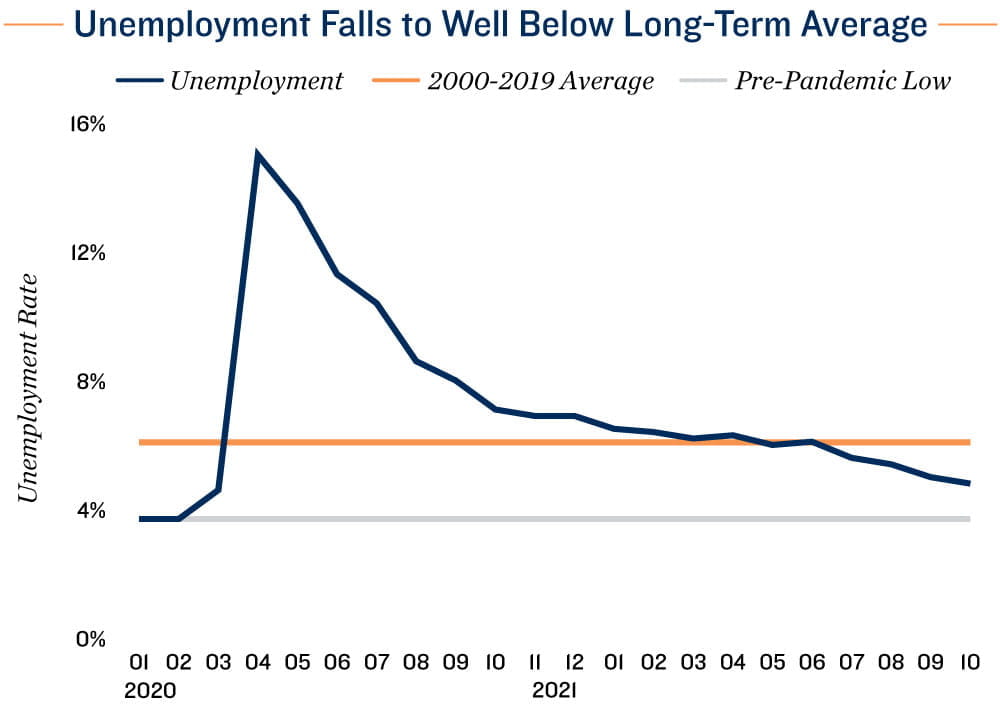

Job creation picks back up. After a slowdown in August and September, hiring improved in October as 531,000 personnel were added to staffs. A downshift in the number of coronavirus infections and the expiration of federal unemployment benefits likely contributed to the greater job creation. Employment growth was most prevalent in the leisure and hospitality sector, predominantly at bars and restaurants, as well as in professional and business services. Last month’s gains helped lower the unemployment rate 20 basis points to 4.6 percent, above the 3.5 percent pre-pandemic low but below the long-run average.

Request a complimentary consultation with the experts.

Please fill out the form below and we will be in touch with you shortly.

Industrial sector posts landmark performance. Amid an ongoing labor shortage, the transportation and warehousing sector added an above-average 54,000 positions last month, reflecting the current state of supply chains. Production delays and port congestion have prompted some retailers and online marketers to increase inventories, adding to warehouse space demand, while the upcoming holidays portend an uptick in distribution volume. Hiring by manufacturers also climbed to 60,000 personnel in October, suggesting these firms are now receiving or are about to collect the parts they need to resume production. Last month’s employment figures signal industrial space demand continues to increase after a record 157 million square feet was absorbed in the third quarter, lowering vacancy to an equally notable 4.4 percent.

Foot traffic at retailers and hotels improves. Bars, restaurants and other retailers expanded headcounts by 154,000 last month, a positive sign that fewer COVID-19 cases translated into greater visits to stores. Nationally, retail vacancy fell 20 basis points year over year in September to 5.3 percent, the first annual decline since 2018. Asking rents also modestly improved, up 2.5 percent on average. Lower health risk may have also prompted more people to travel last month, when 23,000 new positions at hotels were added. Hotel occupancy averaged close to 63 percent in October, up 30 percentage points from a year prior. While occupancy is set to decline through year-end, the driver is traditional seasonality.

Additional Trends

Declining teleworking benefiting office space demand. In October, only 11.6 percent of the employment base worked remotely because of the health crisis, down significantly from 35.4 percent in May 2020. While more employees could possibly be teleworking now for other reasons, the health-related barriers to office returns are declining, affecting space needs. More office space was leased than vacated in the third quarter, the first time this has happened since the first quarter of 2020. These trends suggest that as a sector, office properties may be turning the corner.

Increasing COVID-19 infections raise concerns for winter. After cresting in September, the delta variant wave abated in October, aiding hiring. Coronavirus case counts began to trend up late in the month, however. Going forward colder weather will push more people indoors, increasing infection risks, although broader immunity will likely keep infections from climbing as high as last winter. More companies implementing vaccine mandates may also hinder future job growth, with impacts varying by geography and industry.

4.6% |

5.9% |

|

Unemployment Rate in October 2021 |

Average Unemployment Rate (2000-2019) |

Sources: Marcus & Millichap Research Services; Bureau of Labor Statistics