SELL PROPERTY | BUY | FINANCE | NEWS

News Update

Research Brief

November 5, 2021

Gross Domestic Product

- Real Estate Resilient; Headwinds Weigh On GDP in Third Quarter

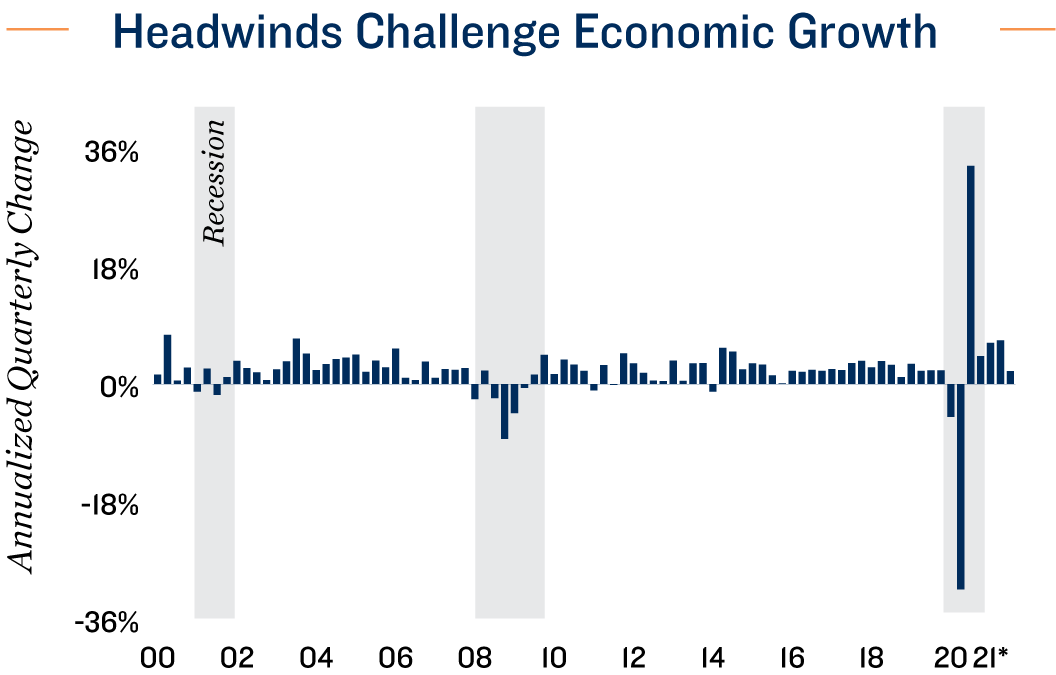

Economic recovery downshifts in third quarter. GDP expanded at a 2.0 percent annualized rate in the third quarter as myriad head- winds weighed on growth. Supply chain issues are hampering consumption despite a record level of savings. Additionally, government stimulus from early 2021 that fueled personal expenditures in the second quarter had largely dissipated by the third quarter. Combined with a surge in COVID-19 cases that kept some people at home, these challenges made consumption the largest drag on growth in the summer period. Although some of these hurdles will persist, the outlook is improving as positive test rates have decreased and the holiday season will bring out more shoppers.

Request a complimentary consultation with the experts.

Please fill out the form below and we will be in touch with you shortly.

Key commercial sectors unfazed by the slowdown. Industrial assets remain in high demand from logistics firms, suppliers and retail back-end operations. The surge in online sales, which are up 30.5 percent since March of 2020, is requiring significantly more inventory held in warehouses. Since the end of 2020, industrial vacancy has declined 100 basis points. Apartments, meanwhile, have exhibited an even stronger performance as household formation surged post lockdowns. A return to college campuses and the addition of millions of jobs aided gains. Through the first three quarters of 2021, multifamily availability declined 160 basis points to below 3 percent, the lowest level in more than two decades.

Outlook improves for challenged real estate. Although not as influential as in the second quarter, services were a net positive to GDP growth in the third period. A large part of that gain came from companies returning to offices and an increase in hiring across multiple service-related sectors. On the office front, midyear appears to be the tipping point for vacancy. In the third quarter, CBD vacancy held steady for the first time in the health crisis while suburban availability decreased by 20 basis points, the first improvement since the middle of 2019. Retail fundamentals, meanwhile, turned around earlier this year and could improve more rapidly once the headwinds that weighed on third quarter GDP abate. Spending has been robust and should continue to grow.

Short-Term Issues to Fade

Economy has potential to break out. While significant, the anchors on economic growth are fixable and, given time, will be sorted. The supply chain will untangle itself as the dozens of ships off the coast of Southern California are unloaded or redirected to available berths elsewhere. Although this process could potentially extend into 2023, longer port hours, relaxed container stacking regulations in Long Beach, and future adjustments could expedite the process. Additionally, inoculation rates continue to rise and the approval of Pfizer’s vaccine for more Americans could push the nation even closer to herd immunity.

Labor market needs to expand. Currently, more than 10 million jobs are available across the country at a time when unemployment is below 5 percent. The source of this wide disparity is the rate of labor force appreciation, or those members of the population who are working or seeking work. In January of 2020, the rate was 63.4 percent, compared with 61.6 percent at the end of the third quarter. As wages continue to rise, some people who have dropped out of the workforce could come off the sidelines, lured by better compensation and a variety of available positions.

2.0% |

13.5% |

|

Annualized 3Q Increase in GDP |

Annualized Growth in Core Retail Sales in September |

*Through 3Q

Sources: Marcus & Millichap Research Services; Bureau of Economic Analysis; Bureau of Labor Statistics; U.S. Census Bureau