SELL PROPERTY | BUY | FINANCE | NEWS

News Update

Research Brief

November 19, 2021

Retail Sales Remain Strong Despite More Shoppers Staying Indoors

Consumer spending healthy in October. Core retail sales, which excludes gasoline and motor vehicles, rose 1.4 percent last month. Year over year, the increase was 14.9 percent as shoppers are flush with capital from pandemic-relief bills and the economic recovery that has pushed unemployment below 5 percent. Sales at gasoline stations are the most robust, growing nearly 47 percent over the past 12 months. A sharp rise in energy demand due to the return to offices in many areas globally is the primary catalyst for the rise in gas prices. Additionally, a 13 percent decline in U.S. crude oil production since prior to the health crisis has tightened supply.

Request a complimentary consultation with the experts.

Please fill out the form below and we will be in touch with you shortly.

Fear of COVID-19 does not deter consumers. Online spending climbed 4.0 percent last month as more people avoided crowds to prevent exposure to the delta variant. Additionally, inclement weather in some high-population areas also kept more people home, especially from restaurants where only vaccinated residents are allowed to dine indoors. Sales at restaurants and bars were flat in October compared with September. Nonetheless, the annual increase is 29.3 percent, second only to gas stations. Grocery stores, meanwhile, reported a 1.1 percent gain in the past month, evidence that more shoppers opted to stay home.

Sales Restrained by Headwinds

Supply chain issues remain impediment to sales. Although the ports of Long Beach and Los Angeles have taken measures to increase the speed at which cargo ships move through the system, dozens of vessels remain anchored offshore and the average time to unload is still 17 days. Some of the goods that residents would like to purchase for the holidays will not make it to shelves or warehouses for online ordering before the end of the year.

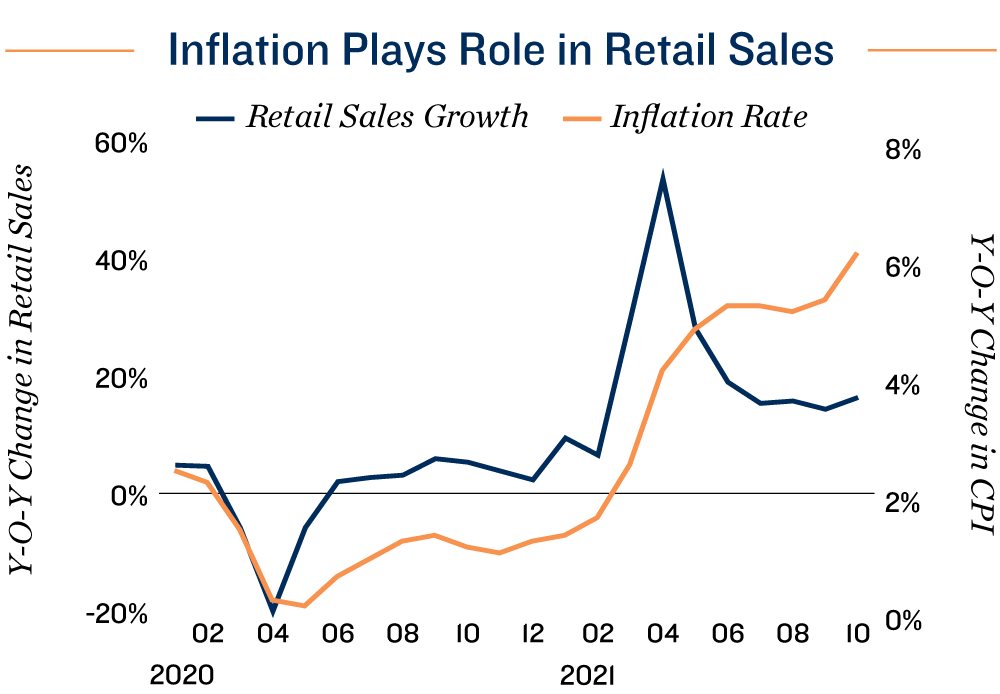

Inflation concerns escalate. The rise in prices are increasingly looking like they are less transitory and are unlikely to decrease even when the annual gain returns to historically normal levels. The producer price index climbed 8.6 percent over the past year, well above the consumer price index. A gap between the two foreshadows further inflationary pressure as expenses are pushed down to consumers. Additionally, the cost to ship a container to the U.S. has skyrocketed, applying more challenges for retailers. While higher prices could raise unadjusted sales in the short term, the acquisition of goods could decline.

14.9% |

46.8% |

|

Gain in Core Retail Sales Since October 2020 |

Increase in Gasoline Sales Since October 2020 |

Sources: Marcus & Millichap Research Services; Bureau of Labor Statistics; CoStar Group, Inc; Placer.ai; U.S. Census Bureau; U.S. Energy Information Administration